postmates tax form online

I dont think you understand how taxes work. This is what they said.

Uber Completes 2 7b Acquisition Of Postmates

5 off your subtotal applied as a discount to the Service Fee.

. It is also sometimes referred to as a. For many Postmates maximizing tax deductions means they pay less in taxes than what they would pay as an employee. As 1099-NEC forms provide annual income and the tax year is not completed yet the form has not been created at.

A 1099 is a piece of paper with your earnings. Dont forget the FREE Stride App can help you save. 1 online tax filing solution for self.

This means that if you work for Postmates you have to track your own taxes. If you have earned more than 600 in one year through Postmates deliveries the company will send you a 1099 form documenting all your earning details. In this video i try my best to explain postmates taxes.

This means that if you work for Postmates you have to track your own taxes. The IRS 1099 form is the one that Postmates -- or any other company that has a contract with freelancers or self-employed people -- will send to them. Postmates is a great way to make money in 2021 especially if you have a car however with tax season coming up theres one thing you must know when it com.

The complete guide to filing your postmates 1099 taxes. Postmates Tax Form Online. As a Postmates delivery driver youll receive a 1099 form.

The best way to figure out if you owe quarterly taxes is to fill out Form. Since taxes arent withheld from your Postmates income its possible you need to pay taxes quarterly. A 1099 form is an information return that shows how much you were paid.

PostmatesUber Tax Form 1099 Help. Usually Postmates drivers get. Earnings you have full access to and.

You can change auto-renew settings in the Unlimited section of your Postmates app. IRS Tax Forms For A Postmates Independent Contractor. IRS Tax Forms For A Postmates Independent Contractor.

You can make many deductions through your work effectively reducing your. Not including taxes and fees. California 1099 Mailing Address from.

While Stride operates separately from Postmates I can. At this time 2021 1099-Forms are not available. They are required to send you a 1099 by January 31.

Since Postmates has been acquired by Uber youll need to reach out to Uber for your 1099.

Postmates Driver Review 2022 Make Money Delivering Stuff

Complete Guide To Postmates Tipping Etiquette Maid Sailors

How To Become A Postmates Driver Part Time Money

The Ultimate Guide To Taxes For Postmates Stride Blog

How To Create An App Like Postmates In 2022 Complete Guide To Follow

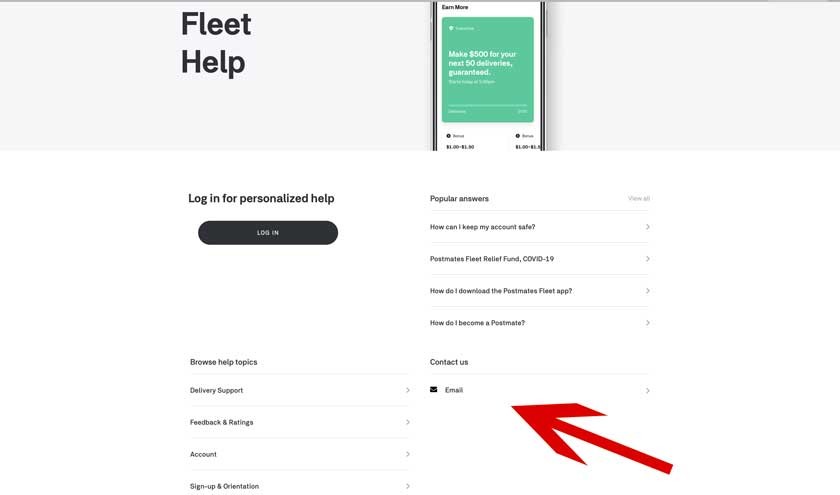

Postmates Customer Service 3 Ways To Contact Postmates Support

![]()

Postmates Food Delivery On The App Store

Understanding 1099 Forms For Delivery Drivers In The Gig Economy

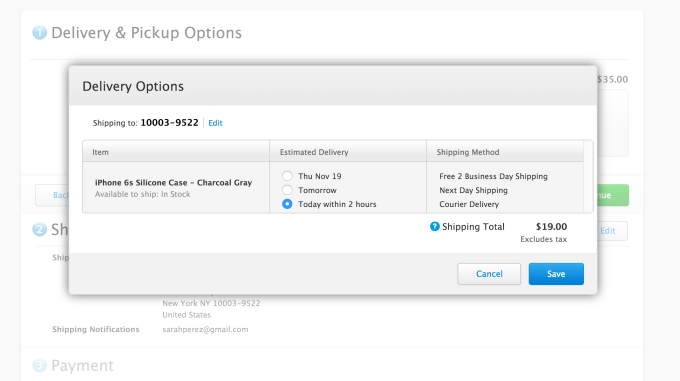

Apple Brings Same Day Delivery To New York Through Expanded Postmates Partnership Techcrunch

Postmates 1099 Taxes The Last Guide You Ll Ever Need

How To Cancel A Postmates Order You Ordered Or Scheduled

Understanding 1099 Forms For Delivery Drivers In The Gig Economy

Postmates Taxes 101 Filing Postmates Taxes For The End Of The Year Youtube

Postmates 1099 Taxes And Write Offs Stride Blog

4 Easy Ways To Contact Postmates Driver Customer Support

Postmates Fleet Your Guide To Joining The Delivery Team Ridester Com

.jpeg)